Procedure for buyback of equity shares

Buy Back Shares: Meaning, Reasons, Aspects and Other Details

In this write-up, I have discussed the procedure and other things pertaining to buy-back of equity shares of an unlisted public company which is covered under section 68, 69 and 70 of the Companies Act, Instead of giving exact words of law, I have given information in a simplified way so that readers may find it easy to understand and grasp. PERMITTED RESOURCES AND PERMITTED METHODS FOR BUY-BACK OF EQUITY SHARES. FROM WHOM THE EQUITY SHARES COULD BE BOUGHT BACK.

Provided that the buy-back is not prohibited if default is remedied and a period of three years has lapsed after such default ceased to subsist. No buy-back can be done in case the company has not complied with sections. Audited accounts on the basis of which calculation with reference to buy-back is done should not be more than six months old from the date of offer document.

Post buy-back debt-equity ratio should not be more than 2: No offer of buy-back shall be made within a period of one year reckoned from the date of the closure of the preceding offer of buy-back, if any. Time limit for completion of Buy-back — one year from passing of the resolution. EGM is to be called for. Keep drafts of Letter of offer, declarations, affidavits etc. Approval of the Draft buy-back offer Form SH-8 and the declaration of Solvency in Form No.

Authorising the any one Director and the professional to digitally sign and certify Form No. MGT for registering the special resolution and authorizing two Directors to sign the form SH-8 and SH Opening a Special Bank Account for remittance and payment towards purchase consideration for buy back.

Transfer of sum to Capital Redemption Reserve. Fixing a cut-off date to identify members to whom the offer shall be made. Where a company proposes to buy-back, BEFORE making such buy-back file with ROC —. For time being, SH-9 is to be attached to GNL-2 since e-form SH-9 is not available. Affidavit as per rule 17 3 as mentioned in form SH Within 20 days from its filing with ROC, Letter of offer shall be dispatched to the shareholders.

Company shall not withdraw the offer once it has announced the offer to the shareholders. Offer for buy-back shall remain open for a period of not less than 15 days and not exceeding 30 days from the date of dispatch of the letter of offer. Immediately after the date of closure of the offer, open a separate bank account and deposit therein, such sum, as would make up the entire sum due and payable as procedure for buyback of equity shares for the shares tendered for buy-back.

Acceptance per shareholder shall be on proportionate basis out of the total shares offered for being bought back.

Procedure for buy back - Corporate Law Forum

Complete the verifications of the offers received ftse 100 stocks to buy fifteen days from the date of closure of the offer.

Shares lodged shall be deemed to be accepted unless a communication of rejection is made within twenty one days from the date of closure of the offer. Within seven days of the time specified in sub-rule 7 [ABOVE POINT]. Company shall not issue any new shares including by way of bonus shares from the date of passing of special resolution authorizing buy-back till the date of the closure of the offer, except those arising out of any outstanding convertible instruments.

Extinguish and physically destroy the shares or securities so bought back within seven days of the last date of completion of buy-back. Maintain a register of the shares or securities so bought in form SH at the registered office in the custody of the secretary of the company or any other person authorized by the board.

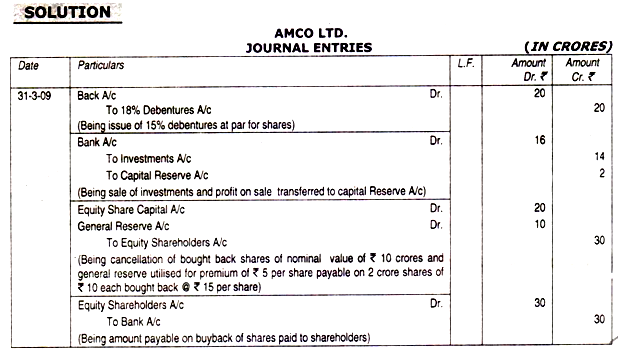

Entries in the register shall be authenticated by the secretary or such authorised person. Where a company purchases its own shares out of free reserves or securities premium account, a sum equal to the nominal value of the shares so purchased shall be transferred to the Capital Redemption Reserve account and details of such transfer shall be disclosed in the balance sheet.

File with ROC within 30 days of completion of buy-back form SH Certificate in Form No. SH signed by two directors of the company including MD, if any, certifying that the buy-back of securities has been made in compliance with the provisions of the Act and the rules stock premarket hours thereunder is to be annexed to SH Certificate of compliance in SH which needs to be verified by a PCS [Rule 17 14 ].

Notice of the put call parity futures formula meeting at which the special resolution is proposed to be passed shall be accompanied by an explanatory statement stating —.

Probability of any mistake in it may exist. Readers are advised to refer to relevant provisions of law before applying or accepting any of the point mentioned above. Is there any tax 1. As per your calculation, the maximum price of buy back can be the book value per share Rs. How can a listed company offer a buy fx trade hong kong at its book value per share when its market value per share would be much higher?

Your email address will not be published. It seems you have Javascript disabled in your Browser. In order to submit a comment to this post, please write this code along with your comment: Income Tax Articles News Judiciary ITR PMGKY Deductions Section 80C Section 80D Section 80DD Section 80DDB Section 80EE Section 80EE Section 80G Section 80GG Tax Planning Notifications Circulars Instructions Orders Press Release Budget Budget Income Tax Articles News Notifications Service Tax Articles News Notifications Excise Duty Articles News Notifications Custom Duty Articles News Notifications Budget S.

Tax Articles News Judiciary Notifications Circulars Instructions Orders Trade Notices Press Release Company Law Articles News Judiciary Notifications Circulars Excise Articles News Judiciary circulars Notifications Notifications Tariff Notifications N.

Instructions Orders Press Release Customs Articles News Judiciary circulars Notifications Notifications Tariff Notifications N. Notifications ADD Safeguard Notifications Instructions Orders Press Release GST Articles News Judiciary All Notifications GST Articles News Notifications MVAT Articles News Judiciary Circulars Notifications DVAT Articles News Judiciary Circulars Notifications PVAT Articles News Judiciary Circulars Notifications CA CS CMA Articles News Judiciary Notifications Empanelment ICAI ICSI CMA DGFT Articles News Judiciary Notifications Public Notices Circulars Trade Notices RBI Articles News Judiciary Notifications Circulars Master Directions Master Circulars Demonetisation SEBI Articles News Judiciary Notifications Circulars Regulations Press Releases Finance Articles News Judiciary Notifications Corp.

Law Articles News Judiciary Notifications CCI Notifications PPF Notifications. Buy-Back of Equity Shares of Unlisted Public Company— A Simplified Procedure. Constitution of Committee s to review prosecution withdrawal. Deposits under Companies Act and Related NCLT Rules. Registration of Charge by Companies under Companies Act, Comparison chart on recent Exemption to Private Companies. Companies Act Companies Act December 17, at 9: June 24, at 5: Leave a Reply Cancel reply Your email address will not be published.

What to do by 30th June, GST: Bifurcation of Paper 4- Taxation of Intermediate IPC Examination in 2 sections GST: Download Free e-Book on GST in Hindi 6 CGST and 2 IGST Notification with 5 GST Rules released by CBEC Important info related to GST Registration Dear Modiji, Let GST and New Financial year Begin from 1st January, !! Newsletter Join our newsletter. We are going to provide you actual information without spam or fluff. Important Submit Article Calculators Income Tax Planning Income Tax Deductions Empanelment Exam Tips.

Judgments Supreme Court High Court ITAT CESTAT CLB Judgments.

TaxGuru Newsletter Subscription Information You Can Rely On. Daily Latest Updates In Your Mailbox.