Stock premarket hours

Traditional Roth IRA Conversion RMD Beneficiary RMD How to Invest Overview Investing Basics Overview Set Your Goals Plan Your Mix Start Investing Stay on Track Find an Account that Fits Waiting Can Be Costly Saving for Retirement Overview How to Save for Retirement Retirement Savings Strategies: What's new Where are my tax forms?

You can do this in two ways:. You may send this page to up to three email addresses at a time. Multiple addresses need to be separated by commas.

The body of your email will read: Sharing this page will not disclose any personal information, other than the names and email addresses you submit. Schwab provides this service as a convenience for you.

By using this service, you agree to 1 use your real name and email address and 2 request that Schwab send the email only to people that you know. It is a violation of law in some jurisdictions to falsely identify yourself in an email.

You also agree that you alone are responsible as the sender of the email. Schwab will not store or use the information you provide above for any purpose except in sending the email on your behalf. Have you wondered what after-hours trading actually is and how it works, and what risks are involved? Here are some answers.

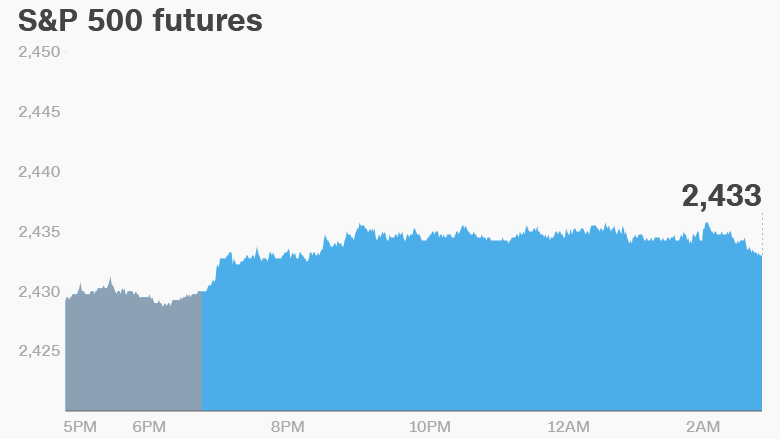

Have you ever turned on the news and heard reports on how a company is doing in after-hours trading after a big earnings announcement? Normal market hours are 9: After-hours trading, as the name implies, is a trading session that occurs after the markets close in which investors can place orders to buy or sell stock. Together both sessions are referred to as extended hours trading.

So how are trades executed when the major exchanges are closed? Extended hours trading is made possible by computerized order matching systems called Electronic Markets which can be either Electronic Communications Networks ECNs or Electronic Stock Exchanges. An electronic market is simply a service that matches up buy and sell orders. If there is, the trade is done, if not, then the order will not be filled. At Schwab, clients can place orders for after-market trading between 4: Commissions and settlement times are the same as for the regular session.

There are, though, several differences between regular session trading and after-hours trading. For example, in the after-hours session, not all order types are accepted. Traders can only use limit orders to buy, sell, or short. Also, after-hours orders are only good for the particular session in which they are placed and do not carry over into any other session. There are several advantages to after-hours trading.

The after-hours session offers extended access to the market. The after-hours session allows them to check out the current quotes and potentially place a trade at a more convenient time. Ability to react to news events: Many companies release earnings after the close of the regular session.

The example below shows IBM making a big move after-hours after releasing their earnings report. This same concept holds true for the pre-market session. Many economic reports, such as the significant monthly employment report, come out at 8: Many companies report earnings before the opening bell as well. At Schwab, pre-market trades can be executed between 8 and 9: Ability to act more quickly to technical signals For traders who rely on technical analysis-based trading strategies, the after-hours session can be very beneficial.

Many technically-oriented traders use closing price and volume figures to calculate trading signals. Once the signal is generated, the trader can place the trade immediately in the after-hours session without having to wait until the next morning when prices could be substantially different than where they were at the close of the regular session. The below is an example of an after-hours trade. While trading in the after-hours session can offer opportunities, there are also unique risks to be considered.

In the regular session, the quotes you see are consolidated and represent the best available prices across all trading venues.

In the after-hours, on the other hand, the quotes are not consolidated.

24 Hour Stock Market and Forex Data - After-Hours Trading - fuwababe.web.fc2.com

You may only see prices from one venue and these may not reflect the prices displayed in other electronic trading systems for the same security. The prices of some securities traded in the after-market may not reflect the prices of those securities at the close or open of the regular session.

What are Premarket and Aftermarket Extended Hours Trading?Liquidity refers to the ability of traders to buy and sell securities easily without materially affecting prices. Generally, the more market participants there are and the more orders that are available, the greater the liquidity, allowing traders to get their orders executed quickly at competitive prices.

Liquidity can be substantially lower in the after-market session. This can lead to delays in execution, partial fills, or no fills at all. Also, some stocks may simply not trade after-hours.

The spread is the difference between the bid the highest price offered by all buyers and the ask the lowest price offered by all sellers. Because of generally lower liquidity, spreads tend to be wider in the after-market session then in the regular session.

Volatility refers to the range of prices that occur in trading. Due to the lower liquidity and wider spreads in the after-market, volatility can be considerably higher than in the regular session. This could lead to inferior pricing on some trades. Lack of calculation of index values: For traders dealing with certain index-based products, the lack of calculation or dissemination of index values in the after-market could put an individual investor at a disadvantage to those professionals who have access to proprietary systems which can quickly calculate index values based on individual stock prices.

The decision to trade after hours depends, of course, on your investment goals, trading style, and risk tolerance. While trading in the extended sessions is not for everybody, for those traders who understand both the potential risks and opportunities, it is certainly an avenue to explore. The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice.

The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision. Securities and market data are depicted for illustrative purposes only, and should not be considered recommendations, offer to sell, or solicitations of offers to purchase any security.

Past performance is no guarantee of future results. The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. Its banking subsidiary, Charles Schwab Bank member FDIC and an Equal Housing Lender , provides deposit and lending services and products.

Access to Electronic Services may be limited or unavailable during periods of peak demand, market volatility, systems upgrade, maintenance, or for other reasons. This site is designed for U. Learn more about our services for non-U.

Unauthorized access is prohibited. Usage will be monitored. Expanded accounts panel with 5 nested items Overview Checking Account There are 1 nested list items FAQs Savings Account Home Loans There are 7 nested list items Today's Mortgage Rates Purchase a Home Refinance Your Mortgage Home Equity Line of Credit Mortgage Calculators Mortgage Process Start Your Loan Pledged Asset Line There are 1 nested list items PAL FAQs.

Find a branch Contact Us.

Extended Hours Stock Trading | Scottrade

You can do this in two ways: Select your online service with one of these buttons. Copy the URL in the box below to your preferred feed reader. Sharpen Your Trading Skills With Live Education Online Courses Local Workshops. Follow us on Twitter Schwab4Traders.

What is after hours trading? How to trade after hours So how are trades executed when the major exchanges are closed? Please try again in a few minutes. Schwab has tools to help you mentally prepare for trading. Talk trading with a Schwab specialist anytime.

Extended Hours Trading - fuwababe.web.fc2.com

Call M-F, 8: Get Commission-Free Online Equity and Options Trades for Two Years. Important Disclosures The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. Orders can be placed at any time and will only be executed from 9: Orders can be placed between 8: ET and will be eligible for execution between 8: Orders can be placed between 4: ET and will be eligible for execution between 4: Trading primarily occurs on exchanges NYSE Euronext and other regional markets and on NASDAQ through a variety of venues including market makers and ECNs.

Many order types and restrictions are accepted. Only limit orders for the particular Extended Hours session are accepted.

Extended-hours trading - Wikipedia

Many security types are available, including: Most listed and NASDAQ securities are available in the extended hours session. All orders are only good for the particular session in which they are placed. There is no carryover into any following session. In general higher trading activity means more liquidity and a greater likelihood of order execution. Lower trading activity may result in lower likelihood of order execution, plus wider spreads and greater price fluctuation.

The quotes you receive are consolidated and represent the best available prices across all trading venues. Market makers and specialists work to ensure customers get the best buy or sell prices displayed on NASDAQ and the exchanges. Quotes are not consolidated and represent the current prices available through the Electronic Market. As a participant in the Extended Hours Trading Network, the Electronic Market may also offer access to prices available on other participating Electronic Markets, but not necessarily all venues open for EHT.