Compound interest stock market calculator

Compound interest or compounding interest is interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan.

The rate at which compound interest accrues depends on the frequency of compounding; the higher the number of compounding periods, the greater the compound interest. Compound interest is calculated by multiplying the principal amount by one plus the annual interest rate raised to the number of compound periods minus one. The total initial amount of the loan is then subtracted from the resulting value.

What would be the amount of interest? In this case, it would be: Because compound interest also takes into consideration accumulated interest of previous periods, the interest amount is not the same for all three years as it would be with simple interest. When calculating compound interest, the number of compounding periods makes a significant difference. The basic rule is that the higher the number of compounding periods, the greater the amount of compound interest.

Compound interest can significantly boost investment returns over the long term. If it's been a while since your math class days, fear not: There are handy tools to help figure compounding.

In fact, it can be done using Microsoft Excel — in three different ways. The first way to calculate compound interest is to multiply each year's new balance by the interest rate.

On Microsoft Excel, enter "Year" into cell A1 and "Balance" into cell B2. Enter years 0 to 5 into cells A2 through A7. The second way to calculate compound interest is to use a fixed formula. Using the same information above, enter "Principal value" into cell A1 and into cell B1.

Next, enter "Interest rate" into cell A2 and ". Enter "Compound periods" into cell A3 and "5" into cell B3. A third way to calculate compound interest in Excel is to create a macro function. First start the Visual Basic Editor, which is located in the developer tab. Click the Insert menu, and click on Module. On the third line of the module, enter "End Function". You have created a function macro to calculate the compound interest rate.

Interest can be compounded on any given frequency schedule, from daily to annually. There are standard compounding frequency schedules that are usually applied to financial instruments.

The commonly used compounding schedule for a savings account at a bank is daily. For a CDtypical compounding frequency schedules are daily, monthly or semi-annually; for money market accountsit's often daily.

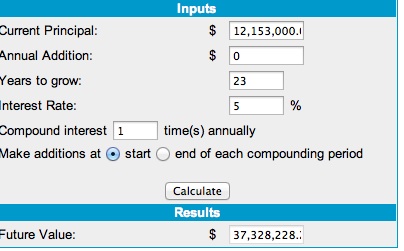

Savings and Compound Interest Calculator

For home mortgage loans, home equity loanspersonal business loans or credit card accounts, the most commonly applied compounding schedule is monthly. There can also be variations in the time frame in which the accrued interest is actually credited to the existing balance.

Interest on an account may be compounded daily but only credited monthly. It is only when the interest is actually credited, or added to the existing balance, that it begins to earn additional interest in the account. Some banks also offer something called continuously compounding interest, which adds interest to the principal at every possible instant. For practical purposes, it doesn't accrue that much more than daily compounding interest unless you're wanting to put money in and take it out the same day.

More frequent compounding of interest is beneficial to the investor or creditor. For a borrower, the opposite is true. Understanding the time value of money and the exponential growth created by compounding is essential for investors looking to optimize their income and wealth allocation. It can only be used for annual compounding. The compound annual growth rate CAGR is used for most financial applications that require the calculation of a single growth rate over a period of time.

The CAGR can be used to estimate how much needs forex xtrade be stowed away to save for a specific objective. The CAGR can also be used to demonstrate the virtues of investing earlier rather than later in life.

On the positive side, the magic of compounding can work to your advantage when it comes to your investments, and can be a potent factor in wealth creation see chart below. Exponential growth from compounding interest is also important in mitigating wealth-eroding factors, like rises in the cost of livinginflation and reduction of purchasing power.

Mutual funds offer one of the easiest ways for investors to reap the benefits of compound interest. Opting cause for stock market crash in 1929 reinvest dividends derived from the mutual fund results in purchasing more shares of the fund. More compound interest accumulates over time, and the cycle of purchasing more shares will continue to help the investment in the fund grow in value.

The compound interest is the difference between the cash contributed to an investment and the actual future value of the investment. Of course, earnings from compound interest are taxable, unless the money is in a tax-sheltered account; it's ordinarily taxed at the standard rate associated with the taxpayer's tax bracket.

An investor who opts for a reinvestment plan within a brokerage account is essentially using the power compound interest stock market calculator compounding, whatever he invests in. Investors can also experience compounding interest with the purchase of capalaba central trading hours australia day zero-coupon bond. Traditional bond issues provide investors periodic interest payments based on the original terms of the bond issue, and because forex ssl indicator are paid out to the investor in the form of best forex dealer ebooks check, interest does not compound.

Zero-coupon bonds do not send interest checks to investors; instead, this type of bond is purchased as a discount to its original value and grows over time.

Zero-coupon bond issuers use the power of compounding to increase the value of the bond so that it reaches its full price at maturity.

Compound Interest Calculator

Compounding can also work for you when making loan repayments. For example, making half your mortgage payment twice a month, rather than making the full payment once a month, will end up cutting down your amortization period and saving you a substantial amount of interest. And speaking of compound interest stock market calculator. The Truth in Lending Act TILA requires that lenders disclose loan terms to potential borrowers, including the total dollar amount of interest to be repaid over the life of the loan and whether interest accrues simply or is compounded.

Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. If the number of compounding periods is more than once a year, "i" and "n" must be adjusted accordingly.

Compound Interest

Calculate Compound Interest Using Excel If it's been a while since your math class days, fear not: Compound Interest Calculators A number of free online compound interest calculators are offered online.

The free compound interest calculator offered through Pine-Grove. It also allows input of actual calendar start and end dates. After inputting the necessary calculation data, the results show interest earned, future value, annual percentage yield and daily interest. Securities and Exchange Commission, offers a free online compound interest calculator. The calculator is fairly simple, but it does allow inputs of monthly additional deposits to principal, which is helpful for calculating earnings where additional monthly savings are being deposited.

A free online interest calculator with a few more features is available at TheCalculatorSite. The calculator offered there allows calculations for different currencies, the ability to factor in monthly deposits or withdrawals, and the option to have inflation -adjusted increases to monthly deposits or withdrawals automatically calculated as well.

How Often is Interest Compounded? This concept is known as the time value of money and forms the basis for relatively advanced techniques like discounted cash flow DCF analysis.

The opposite of compounding is known as discounting ; the discount factor can be thought of as the reciprocal of the interest rate, and is the factor by which a future value must be multiplied to get the present value. One way is to look at your repayment schedule. With simple interest, each year's interest payment, and the total amount you owe, would be the same.

If the interest is compounded, each year's interest payment would be larger. Another method is to compare a loan's interest rate to its annual percentage rate APRwhich the TILA also requires lenders to disclose. The APR converts the finance charges of your loan, which include all interest and fees, to a simple interest rate.

A substantial difference between interest rate and APR means one or both of two things: Periodic Interest Rate Discrete Compounding Effective Annual Interest Rate Continuous Compounding Compound Return Compounding Annual Percentage Yield - APY Biotech Compound Stated Annual Interest Rate. Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers.

Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.