Journal entry for foreign exchange gain or loss

Accounting Study Guide by AccountingInfo. GAAP Codification IFRS International Standards Accounting Topics Accounting Journal Entries Review and Practice Materials U. Tax Code by Section What is a journal entry in Accounting? Journal entry is an entry to the journal.

Journal is a record that keeps accounting transactions in chronological order, i. Ledger is a record that keeps accounting transactions by accounts. Account is a unit to record and summarize accounting transactions. All accounting transactions are recorded through journal entries that show account names, amounts, and whether those accounts are recorded in debit or credit side of accounts.

Double-entry implies that transactions are always recorded using two sides, debit and credit. Debit refers to the left-hand side and credit refers to the right-hand side of the journal entry or account. The sum of debit side amounts should equal to the sum of credit side amounts.

A journal entry is called "balanced" when the sum of debit side amounts equals to the sum of credit side amounts. T-account is a convenient form to analyze accounts, because it shows both debit and credit sides of the account.

Steps Self-Questions Answers 1 What did Company A receive?

IAS 21 The Effects of Changes in Foreign Exchange Rates - IFRSbox

Receiving cash increases the cash balance of the company. Debit side Left side. Credit side Right side. In other words, does this journal entry balance? It increases supplies balance. Accounting Journal Entries Review and Practice Materials.

Tax Code by Section. What is a journal entry in Accounting? Double-Entry Recording of Accounting Transactions. To record transactions, accounting system uses double-entry accounting.

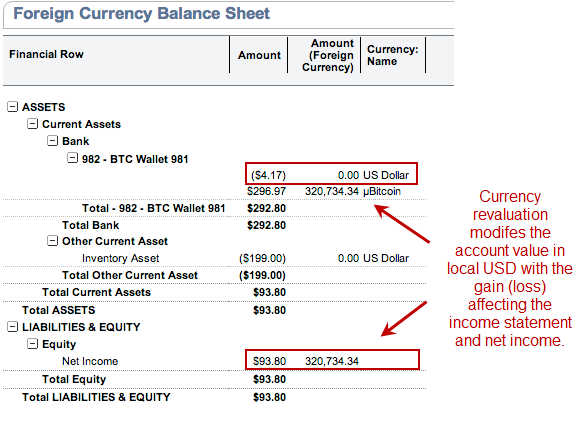

illustration entries for currency exchange gains and losses

This form looks like a letter "T", so it is called a T-account. Examples of Journal Entries. What did Company A receive? If Company A received cash, how would this affect the cash balance? Which side of cash account represents the increase in cash? What is the account name to record the sales of products. Which side of sales account represents the increase in sales? Does the sum of debit side amounts equal to the sum of credit side amounts? If Company A received supplies, how would this affect the supplies balance?

Which side of supplies account represents the increase in cash? Which side of cash account represents the decrease in cash? Debits and Credits of Accounts. Increase in asset accounts. Decrease in asset accounts. Increase in expense accounts. Decrease in expense accounts. Decrease in liability accounts. Increase in liability accounts. Decrease in equity accounts. Increase in equity accounts.

Decrease in revenue accounts. Increase in revenue accounts. Normal Balances of Accounts. Accounts have normal balances on the side where the increases in such accounts are recorded. Asset accounts have normal balances on debit side.

Expense accounts have normal balances on debit side. Liability accounts have normal balances on credit side.

Equity accounts have normal balances on credit side. Revenue accounts have normal balances on credit side. In the financial statements, accounts are reported on the sides where they have normal balances. More Examples of Accounting Journal Entries. Accounting Changes and Error Corrections, ASC Accounting Equation Accounting Journal Entries Accounts Receivable Accrual Basis Accounting Accruals and Deferrals Adjusting Entries Asset Retirement and Environmental Obligations, ASC Assumptions of Financial Reporting Balance Sheet, ASC Bank Reconciliation Business Combinations, ASC Capital Leases, ASC Capitalization of Interest, ASC Capitalized Advertising Costs, ASC Cash and Cash Equivalents Characteristics of Useful Information Classification of Assets Classification of Inventory Classification of Liabilities Classified Balance Sheet Classified Balance Sheet Practice Closing Journal Entries Codification of U.

GAAP, ASC Compensation: Stock Compensation, ASC Components of Stockholders' Equity Comprehensive Income, ASC Consolidation, ASC Consolidation, Noncontrolling Interests, ASC Consolidation, Variable Interest Entities, ASC Contingencies, ASC Cost Flow Assumptions Cost Method Investments, ASC Cost of Inventory Costs of software to be sold, leased, or marketed, ASC Debits and Credits Defined Benefit Plans: Pension, ASC Depreciation Methods Derivatives and Hedging, ASC Disposal of Property, Plant and Equipment Distinguishing Liabilities from Equity, ASC Earnings per Share, ASC Elements of Balance Sheet Elements of Financial Statements Elements of Income Statement Equity Method, ASC Equity Assaxin 8 binary options price calculator Exit or Disposal Cost Obligations, ASC Extraordinary and Unusual Items, ASU Fair Value Measurements and Disclosures, ASC Fair Value Measurements and Disclosures, ASC Financial Instruments, ASC Foreign Currency Matters, ASC Foreign Currency Transactions, ASC Forms of Business Organizations Gain Contingencies, ASC Generally Accepted Accounting Principles GAAP Generally Accepted Accounting Principles, ASC Goodwill and Other, ASC IAS 1 Presentation of Financial Statements, Overview IAS 1 Presentation of Financial Statements, Review IAS 1 Presentation of Financial Statements, U.

GAAP Comparison IAS 12 Income Taxes, Overview IAS 12 Income Taxes, Review IAS 16 Property, Plant and Equipment, Overview IAS 16 Property, Plant and Equipment, Review IAS 17 Leases, Review IAS 18 Revenue, Review IAS 19 Employee Benefits, Review IAS 2 Inventories, Overview IAS 2 Inventories, Review IAS 2 Inventories, U. GAAP Comparison IAS 20 Accounting for government grants how to get cash in tetris battle facebook disclosure of government assistance IAS 21 The effects of changes in foreign exchange waitforexit c#, Overview IAS 21 The effects of changes in foreign exchange rates, Review IAS 21 The effects of changes in foreign exchange rates, U.

GAAP Comparison IAS 23 Borrowing Costs, Overview IAS 23 Borrowing Costs, Review IAS 23 Borrowing Costs, U. GAAP Comparison IAS 24 Related Party Disclosures, Review IAS 26 Accounting and Reporting by Retirement Benefit Plans, Review IAS 27 Separate Financial Statements, Overview IAS 27 Separate Financial Statements, Review IAS 27 Separate Financial Statements, U. GAAP Comparison IAS 28 Investments in Associates, Review IAS 29 Financial Reporting in Hyperinflationary Economies, Review IAS 32, Financial Instruments: Presentation, Free trial futures trading IAS 32, Financial Instruments: GAAP Comparison IAS 7 Statement of Cash Flows, Review IAS 7 Statement of Cash Flows, U.

GAAP Comparison IAS 8 Accounting policies, changes in Accounting Estimates and Errors, Overview IAS 8 Accounting policies, changes in Accounting Estimates and Errors, U. GAAP Comparison IAS 8 Accounting policies, changes in Accounting Estimates and Errors, Review Imputation of Interest, ASC Income Statement, ASC Income Statement, Extraordinary and Unusual Items, ASC Intangibles Other than Goodwill, ASC Interest, ASC Interim Reporting, ASC Internal Use Software, ASC Inventory Analysis Inventory Recording Systems Inventory, ASC Investments in Debt and Equity Securities Investments: Debt and Equity Securities, ASC Investments: SEC Staff Accounting Bulletin Topic 13, ASC Sale of Financial Assets, ASC Sale-Leaseback Transactions, ASC Servicing Assets and Liabilities, ASC Statement of Cash Flows, ASC Steps of Accounting Cycle Stock Dividends, Stock Splits, ASC Journal entry for foreign exchange gain or loss Events, ASC The Objective of Accounting Transfers of Securities: Between Categories, ASC Translation of Financial Statements, ASC Treasury Stock, ASC Types of Business Activities Types of Financial Statements Users of Accounting Information Website Development Costs, ASC Where can I find the text of IFRS standards?

Accounting Standards Update ASU Accounting Standards Update ASU Accounting Standards Update ASU Accounting Standards Update ASU Accounting Standards Update ASU Accounting Standards Update ASU Accounting Standards Update ASU Accounting Standards Update ASU Accounting Standards Update ASU Accounting Standards Update ASU Accounting Standards Update ASU Accounting Standards Update ASU Accounting Standards Update ASU Accounting Standards Update ASU Accounting Standards Update ASU Accounting Standards Update ASU Accounting Standards Update ASU Accounting Standards Update ASU Accounting Standards Update ASU Accounting Standards Update ASU Accounting Standards Update ASU Accounting Standards Update ASU Accounting Standards Update ASU Accounting Standards Update ASU This section provides study guides for students in the principles of accounting courses or introduction to financial accounting courses.

GAAP by Topic Hierarchy of U. Financial Statements Examples of Financial Statements Balance Sheet: Accounting Cycle Journals and Ledgers Adjusting Journal Entries Trial Balance. Present Value, Future Value PV, FV Conversion Tables Simple and Compound Interest Calculations. Accounting for General Users: A guide to accounting for users who are interested in understanding accounting reports.

This section explains what users need to know to understand and analyze accounting information provided in the financial statements. No prerequisite is required to read this section. CPA and Accounting Profession How to become a Certified Public Accountant CPA. Accounting is an information system. Users of accounting information Financial accounting for external users Managerial accounting for internal users.

Examples of Financial Statements Financial Statements Index Balance Sheet: Examples Balance Sheet Income Statement Statement of Cash Flows Statement of Stockholders' Equity Annual Report Project Resources. Elements of Financial Statements SFAC No. Balance Sheet provides information about financial position of a company. Examples of Asset Accounts Examples of Liability Accounts Examples of Stockholders' Equity Accounts.

Income Statement provides information about the performance of a company. Earnings Per Share EPS Revenue Recognition Principle Examples of Revenue and Gain Accounts Examples of Expense and Loss Accounts.

Statement of Cash Flows provides information about the cash flow of a company. Cash flow from operating activities Cash flow from investing activities Cash flow from financing activities. This section provides study guides for students in the intermediate accounting courses.

Following topics are discussed in this section. Accounting for Inventories First In First Out FIFO Last In First Out LIFO Dollar Value LIFO Retail Inventory Method Gross Profit Method Lower of Cost or Market LCM. Investments in Debt and Equity Securities Trading securities Available for sale securities Debt securities. Goodwill and Other Intangible Assets Loss and Gain Contingencies Extraordinary Gains and Losses Discontinued Operations Earnings per Share Basic and Diluted EPS.

Depreciation Methods Straight Line Depreciation Declining Balance Method Sum-of-the-years-digits Method. Accounting for Bonds Payable Price of bonds payable Discount on bonds payable Premium on bonds payable Amortization of discount and premium Early extinguishment of debts. Stockholders' Equity Common stock Preferred stock Par value Additional paid-in capital Retained earnings Treasury stock Cost method, par value method Dividends Cash dividend, Stock dividend Stock split Initial Public Offering IPO Subsequent Events Code of Professional Conduct for Accountants.

This section provides study guides for students in the advanced accounting courses. Consolidated Financial Statements Business Combinations Accounting for Leases. GAAP by Codification Topic. International Financial Reporting Standards IFRS.