Forex trade commission

Our award-winning investing and trading experience at a new lower price. And with flat-rate commissions on all trades, no share limits, and no trade requirements to access advanced features, there are no surprises. Don't let trading fees eat up your profits. That's the price you pay regardless of your account balance or how often you trade. TD Ameritrade features more than commission-free, non-proprietary ETFs. Carefully consider the investment objectives, risks, charges, and expenses of an exchange traded fund before investing.

To obtain a prospectus containing this and other important information, please visit www. Please read the prospectus carefully before investing. Orders executed in multiple lots on the same trading day will be charged a single commission.

When an order is partially executed over multiple trading days, the order is subject to a separate commission charge for each trading day.

To trade commission-free ETFs you must be enrolled in the program. ETFs eligible for commission-free trading must be held at least 30 days. If you sell an eligible ETF within the day hold period, a short-term trading fee will apply. Commission Schedules and Fees may vary by program, location or arrangement and are subject to change upon 30 days notice.

All prices are shown in U. These charges are typically based on fees assessed under various regulations applicable to transactions. It may include any of the following: TD Ameritrade offers hundreds of no-transaction-fee NTF funds from leading fund families. Rather than promoting our own mutual funds, TD Ameritrade has tools and resources that can help you choose mutual funds that match your objectives. Carefully consider the investment objectives, risks, charges, and expenses of a mutual fund before investing.

This fee is in addition to any fees addressed in the fund's prospectus. No-transactions-fee funds have other fees and expenses that apply to a continued investment in the fund and are described in the prospectus. Plus, nickel buyback lets you buy back single order short option positions - for both calls and puts - without any commissions or contract fees if the price is a nickel or less.

There is no waiting for expiration. TD Ameritrade charges a Reg Fee on certain transactions. You have your choice of offerings ranging from the simplest CD to more complex, structured fixed-income investment at affordable pricing with TD Ameritrade. Add bonds or CDs to your portfolio today. TD Ameritrade may act as principal on any fixed-income transaction.

When acting as principal and receiving compensation on a net yield basis, we will add a markup to any purchase, and subtract a markdown from every sale. The markup or markdown will be included in the price and yield quoted to you. You'll have easy access to a variety of available investments when you trade futures with a TD Ameritrade account, including energy, gold and other metals, interest rates, stock indexes, grains, livestock and more. A transparent Plus Fees pricing structure includes the commission plus the specific exchange and regulatory fees.

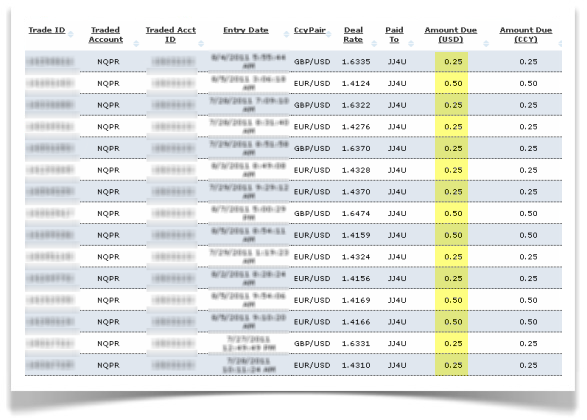

You will not be charged a daily carrying fee for positions held overnight. Learn more about futures trading. Exchange fees may vary by exchange and by product. See below for pricing and terms regarding commission-based forex pairs, as well as margin requirements. The cost of the trade is reflected in wider spreads and TDAFF is compensated by its liquidity provider based on the volume of non-commission pairs.

Commission currency pairs trade in increments of 1, and are subject to a fixed-commission structure based in counter currency units.

As of October 17, , at 5 pm EDT, the maximum leverage on all major currency pairs is If you request a distribution from your Individual Retirement Account IRA and you do not make an election regarding state tax withholding, your state of residence may require withholding at a statutory minimum rate.

This information is provided to help you understand state income tax withholding requirements for IRA distributions. TD Ameritrade does not provide tax advice and cannot guarantee accuracy of state tax withholding information as state laws are subject to change and interpretation. State income tax will be withheld only if you instruct us to do so. If you want state income tax to be withheld, you must indicate the amount or percentage. State income tax will not be withheld from your distribution, even if you elect to withhold state income tax.

State income tax will be withheld regardless of federal income tax election, unless you elect not to withhold. If you make no election, Delaware requires that withholding be taken at the minimum rate of 5. If electing a total distribution, you must elect to withhold state income tax when federal income tax is withheld from your distribution. If you do not make an election, District of Columbia requires that withholding be taken at the minimum rate of 8.

Forex Pricing - FXCM

If electing a partial distribution, State income tax will be withheld only if you instruct us to do so. You must elect to withhold state income tax when federal income tax is withheld from your distribution. If you do not make an election, it will be withheld at the minimum rate of 5. If you make no election, Kansas requires that withholding be taken at the minimum rate of 4.

If you do not make an election, it will be withheld at the maximum rate of 5. Michigan requires state income tax for all distributions. If you make no election, Michigan requires that withholding be taken at the minimum rate of 4. The forms can be mailed to us at the address shown at the top of the distribution form, or faxed to us at Please note that reducing or eliminating this withholding may subject you to underpayment penalties.

We suggest you consult with a tax-planning professional for more information. Premature distributions have voluntary withholding elections with no minimums. All other distributions you must elect to withhold state income tax when federal income tax is withheld from your distribution. North Carolina requires state income tax for all distributions. If you make no election, North Carolina requires that withholding be taken at the minimum rate of 4.

Residents can choose to have a smaller percentage withheld, or opt out of withholding entirely, by submitting a new distribution form and a North Carolina Form NC—4P.

OANDA - Exceptional Execution, Fast & Reliable | OANDA

If your distribution is an eligible rollover distribution, you do not have the option of electing not to have State income tax withheld from the distribution.

If you do not make an election, Oklahoma requires that withholding be taken at the minimum rate of 5. If you make no election, Oregon requires that withholding be taken at the minimum rate of 8. Check the background of TD Ameritrade on FINRA's BrokerCheck. Residents can choose to have a smaller percentage withheld, or opt out of withholding entirely, by submitting a new distribution form and a North Carolina NC-4P form. Market volatility, volume, and system availability may delay account access and trade executions.

All investing involves risk, including loss of principal. When redeemed, an investment may be worth more or less than the original investment amount. Investments in fixed income products are subject to liquidity or market risk, interest rate risk bonds ordinarily decline in price when interest rates rise and rise in price when interest rates fall , financial or credit risk, inflation or purchasing power risk and special tax liabilities.

Investments in fixed income products are subject to market risk, credit risk, interest rate risk and special tax liabilities. May be worth less than the original cost upon redemption. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

Please read Characteristics and Risks of Standardized Options before investing in options. Offer is not valid on tax-exempt trusts, k accounts, Keogh plans, Profit Sharing Plan, or Money Purchase Plan. Offer is not transferable and not valid with internal transfers, TD Ameritrade Institutional accounts, accounts managed by TD Ameritrade Investment Management, LLC, current TD Ameritrade accounts or with other offers.

Qualified commission-free Internet equity, ETF or options orders will be limited to a maximum of and must execute within 60 calendar days of account funding. Contract, exercise, and assignment fees still apply.

Limit one offer per client. Account value of the qualifying account must remain equal to, or greater than, the value after the net deposit was made minus any losses due to trading or market volatility or margin debit balances for 12 months, or TD Ameritrade may charge the account for the cost of the offer at its sole discretion. TD Ameritrade reserves the right to restrict or revoke this offer at any time. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business.

Please allow business days for any cash deposits to post to account. Taxes related to TD Ameritrade offers are your responsibility. Please consult a legal or tax advisor for the most recent changes to the U. Waiver of NASDAQ Level II and Streaming News subscription fees applies to non-professional clients only. Access to real-time market data is conditioned on acceptance of exchange agreements.

TD Ameritrade does not charge platform, maintenance, or inactivity fees. Commissions, service fees, and exception fees still apply. Please review our commission schedule and rates and fees schedule for details. Futures and futures options trading is speculative, and is not suitable for all investors.

Clients must consider all relevant risk factors, including their own personal financial situation, before trading. Forex trading involves leverage, carries a high level of risk and is not suitable for all investors. Futures and forex accounts are not protected by the Securities Investor Protection Corporation SIPC. Not all account owners will qualify.

To get the best possible experience using our website, we recommend you update your browser. Choose a start page My Account Overview Home Balances Stock Quote Order Status Positions Trade Stocks Trade Options Trade Mutual Funds Trading Tools. Home Why TD Ameritrade?

Trade commission—free for 60 days. More value at a new lower price Open new account.

Stocks ETFs Mutual Funds Options Fixed Income Futures Forex Currency. Trade Unlimited Shares market or limit.

Mutual Funds Mutual Funds. Equity or index, market or limit orders. Options involve risks and are not suitable for all investors.

Fixed Income Fixed Income. New issue On a net yield basis Secondary On a net yield basis.

New issue Placement fee from issuer Secondary Placement fee from issuer TD Ameritrade may act as principal on any fixed-income transaction. Forex Currency Forex Currency.

Liquidation of positions will occur: Tax Withholding If you request a distribution from your Individual Retirement Account IRA and you do not make an election regarding state tax withholding, your state of residence may require withholding at a statutory minimum rate.

Select a State Alabama Alaska Arizona Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey New Mexico New York North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania Rhode Island South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming Lookup.

Voluntary State Income Tax Withholding State income tax will be withheld only if you instruct us to do so. Prohibits State Income Tax Withholding State income tax will not be withheld from your distribution, even if you elect to withhold state income tax.

Error (Forbidden)

A Mandatory State Income Tax Withholding State income tax will be withheld regardless of federal income tax election, unless you elect not to withhold. District of Columbia Has: A Mandatory State Income Tax Withholding When Federal Income Tax is Withheld If electing a total distribution, you must elect to withhold state income tax when federal income tax is withheld from your distribution.

A Mandatory State Income Tax Withholding When Federal Income Tax is Withheld You must elect to withhold state income tax when federal income tax is withheld from your distribution. A Mandatory State Income Tax Withholding Michigan requires state income tax for all distributions. State Income Tax Withholding Premature distributions have voluntary withholding elections with no minimums.

A Mandatory State Income Tax Withholding North Carolina requires state income tax for all distributions. Careers Search Jobs Minimum Requirements Disclosures Privacy Financial Statement Newsroom Site Map Security TD Ameritrade Institutional TD Ameritrade Holding Corp. Futures accounts are not protected by the Securities Investor Protection Corporation SIPC.