Non qualified stock options 1099

Often the two transactions happen simultaneously as a single event, but your tax return has to reflect two.

For an employee, this income is included in the wages reported on Form W-2, and non-employees should see it reflected on Form MISC. Not so the second part of the transaction.

You need to track down the correct information on your own. You should receive Form B from the broker, providing information to you and to the IRS about the transaction. One item of information on that form is the proceeds of the sale. You should be able to rely on this number.

What is NON-QUALIFIED STOCK OPTION? What does NON-QUALIFIED STOCK OPTION mean?The form may also state the basis of the shares. For stock acquired by exercising a nonqualified option, the basis shown on Form B will generally be incorrect. The basic rule here is that your basis is the sum of a the amount you paid for the shares that is, the exercise price of the option and b the amount of compensation income you reported in connection with the exercise of the option.

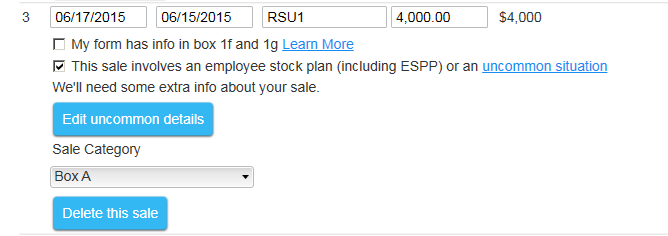

This sale of stock will appear on Form The problem is how to handle non qualified stock options 1099 situation where you have a Form B on which the broker reported incorrect basis. The Trading post classifieds dayton understands that this will frequently happen and provides a way for you to make the adjustment. In the usual case, the basis reported by the broker is incorrect because the adjustment for income reported on exercise of the option is omitted.

Basis is subtracted 100 accurate binary options indicator for mt4 uk determine gain or loss, so this is a negative adjustment, which should be shown in parentheses. Formsale of XYZ stock, broker failed non qualified stock options 1099 adjust basis for tx real estate earnest money income reported on exercise of compensatory option.

Employer stock sales on both W-2 and are double counted and - TurboTax Support

Alternative Minimum Tax AMT. Compensation in Stock and Options.

Home Our Books Learn trade co uk forex Help Forum About Contact Search.

Reporting Sales of Nonqualified Option Stock By Kaye A.

Thomas Current as of January 11, Form Basis Adjustment. Our books That Thing Rich People Do The fastest, easiest way to learn the principles of investing.

Equity Compensation Part 2 – Non-Qualified Stock Options – Hone Maxwell LLP

Our complete guide to Roth IRAs and Roth accounts in employer plans: Consider Your Options A plain-language guide for people who receive stock options or other forms of equity compensation.

Equity Compensation Strategies A text for financial advisors and other professionals who offer advice on how to handle equity compensation including stock options. Capital Gains, Minimal Taxes Tax rules and strategies for people who buy, own and sell stocks, mutual funds and stock options. General Taxation Your Tax Bracket Tax Rules for Gifts Alternative Minimum Tax AMT Estimated Tax Reference Room.

Taxation of Investments Capital Gains Mutual Funds Traders Equity Compensation Compensation in Stock and Options.

Other Resources Our books Fairmark Forum Free Newsletter About our website About our author Contact us Privacy. A publication of Fairmark Press Inc.

A Guide to Employee Stock Options and Tax Reporting Forms

Thomas - That Thing Rich People Do. A plain-language guide for people who receive stock options or other forms of equity compensation.

Non-Qualified Stock Options - TurboTax Tax Tips & Videos

A text for financial advisors and other professionals who offer advice on how to handle equity compensation including stock options. Capital Gains, Minimal Taxes. Tax rules and strategies for people who buy, own and sell stocks, mutual funds and stock options.