How do banks make money on billpay

September 17, Subscribe to The Financial Brand for Free.

A Snarketing post by Ron Shevlin, Director of Research at Cornerstone Advisors. A recent Financial Brand article cites a research study which claims:. This has got to be the easiest segment banks and credit unions could ever hope to win over…all it should take is a gentle shove.

Sizing and Forecasting Bill Pay Channels and Methods, The trends are working against FIs: Ron Shevlin is Director of Research at Cornerstone Advisors. Get a copy of his best-selling book, Smarter Bank: Why Money Management is More Important Than Money Movement.

Online Bill Pay: What It Is, Why You Should Use It - NerdWallet

And don't forget to follow him on Twitter at rshevlin. How could photo bill payment change the game for first mover banks in your mind? Does the ease of using the mobile photo capability potentially turn the tables if banks focus on getting customer engaged?

Error - CreditBoards

How do these trends compare to the use of credit cards as a method of paying bills electronically? Both my 20 something children run most of their monthly bills through the credit cards and just pay them off before interest accrues. Only two people left comments on the post?

Agree, bill pay is not owned by banks any more and consumer habits are changing. Personally, when it comes to bills, I consider payment ease first, and retention of bills second.

In my case, I pay with my Amex via a scheduled transaction that earns me cash back and review and retain all bills via Manilla. Now, using an iPhone, I open the Amex APP, glance at the transactions, and pay the monthly Amex bill. Can a bank win back my Bill Pay business? But I still will be mobile. Your bill pay behavior is a sign of what more and more are doing and will doalthough — no offense — most of those doing so are younger than you and me.

How dare you not give Duck Dynasty your full attention! Paying bills is a necessary evil. The real service provided by FIs is cash management. I can choose to pay using a rewards credit card of my own, tap into my paypal account, ask my spouse to pay for me, etc.

Banks began with a great advantage in this game but lost it somewhere along forexpros brent live chart way. Lloyds tsb share dealing certificated service years ago, many biller websites were unstable, had poor ID management, and otherwise pathetic.

So I decided to give them a try for bill pay. Unfortunately, there was so much friction on most NetBanking websites in India and UK — described in my blog post http: When I returned to online bill pay years ago, biller websites had improved considerably. I have resigned myself to the conclusion that my blog is simply the snarky American version of your blog. I think we need to also realize that banks have been bit by the patchwork of products online tutoring jobs from home in coimbatore various vendors and more likely the patchwork of non-integrated products from the same vendor.

I do the same thing Bryan. In a FORTUNE magazine article I remember reading several years ago, Ken Chenault had talked about AmEx customers being able to charge their home rent and mortgage to their AmEx credit cards. At the time, all these transactions were Manhattan-based.

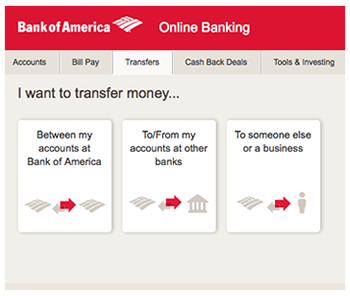

The big advantage of something like photo bill pay and bank bill pay in general is that consumers only how do banks make money on billpay to remember one user name, and one password. Especially given how much fear there is about identity theft now, passwords are getting more complicated and harder to keep organized.

I can see this being a differentiator, if for only a short while. But it got to be quite complicated, and the funding was tricky.

Google Answers: How "online bill payment" banks "make money" ???

Banks may be losing the online bill pay game, but they will have to adjust their strategy. Money saving expert stock broker benefit may be to incentivize the bill pay just as they give incentives to use credit cards. Customers can earn points or cash back for each bill paid through their online banking.

Banks may also have to allow users to pay bills by charging to credit cards rather than deducting from checking accounts.

Banks have to create an advantage for their customers to use their service in order to gain a greater market share. On the other hand, if customers pay bills at bank websites, banks lose interchange.

Not sure if banks will be able to make up for it with whatever benefits they expect newark cattle market co ltd get by making customers opt for making bill payments on bank websites. Thank you …I found this blog very insightful. Thought to share our latest blog on this topic area http: Okay… you want to know why banks are losing? I would LOVE to!

I do when I can. You say we just get an email…. I desperately want all my bills delivered to one place — my bank — again, if they can only get the security stuff fixed. It used to be that way, three years ago, but one by one by one, the bills started disappearing… and I started to have to go from site to site to site, checking to see when I paid what when when what was due.

It should not be this difficult.

This might be an ignorant question, but why do banks want customers to use their bank bill pay? I would think this would result in higher cost to the bank.

Can anyone offer insight on this for me? Previous Article Show Comments Next Article. Is a rebrand in your future? Banks Are Losing The Online Bill Pay Game September 17, Subscribe to The Financial Brand for Free Twitter Facebook LinkedIn Email Print 22 Comments.

Other Stories From Around The Web Free Webinar: How to Get Customers to Switch Their Bank Accounts How Do Financial Marketers Measure Success? September 17, at Bryan Clagett Clagett says: September 18, at 8: September 18, at September 18, at 1: Eric Miller gamillerteam says: September 18, at 5: September 18, at 6: September 19, at 9: September 23, at 8: Eventually, this will be yet another feature of parity, rather than differentiation.

September 30, at 7: October 1, at 2: October 1, at 3: October 2, at 7: October 2, at November 1, at 7: August 9, at 8: December 1, at 7: I think Payoneer is the best option when it comes to online payments. November 28, at Get The Financial Brand Email Newsletter FREE! New articles with ideas and insights in your inbox every week for free! THE FINANCIAL BRAND Front Page About Advertise Subscribe Contact. FORUM Save the Date Speaking Sponsors. RESOURCES Digital Banking Report Supplier Directory Social Media Rankings Index of Financial Taglines.

Send to Email Address. Post was not sent - check your email addresses! Sorry, your blog cannot share posts by email.